Biotech in Orbit: Capitalizing on Microgravity

The investment thesis for In-Orbit Biomanufacturing (IOB) is driven by a fundamental shift in unit economics. As heavy-lift launch costs collapse, the cost of access to Low Earth Orbit (LEO) has fallen below the value-per-gram threshold of high-fidelity pharmaceutical products. We are no longer paying to "explore" microgravity; we are paying to utilize it as a unique manufacturing environment that offers yields and purities physically impossible to achieve in a 1G (Earth gravity) environment.

This report analyzes the specific market mechanics of the IOB sector, focusing on the two highest-margin verticals: Protein Crystallography and Regenerative Tissue Engineering.

The Physics of Profit: Why Manufacture in Orbit?

To an investor, microgravity should be viewed not as a lack of weight, but as the elimination of fluid dynamics variables.

On Earth, biomanufacturing is plagued by two physical forces:

Sedimentation: Heavier particles sink, causing separation in mixtures.

Convection: Heat causes fluid movement, creating turbulence at the molecular level.

In LEO, these forces are effectively nullified. This creates a quiescent, diffusion-dominated environment where molecular assembly occurs with near-perfect symmetry. For specific high-value compounds, this environment transforms the production line, converting low-yield terrestrial processes into high-fidelity orbital operations.

Vertical 1: Small Molecule & Protein Crystallography

The "Bio-Better" Strategy

The immediate commercial application for IOB is the reformulation of existing blockbuster drugs.

The Problem: On Earth, convection currents cause protein crystals to grow irregularly and with defects. This limits the concentration and stability of pharmaceutical formulations.

The Orbital Solution: In microgravity, crystals grow larger, more uniform, and with higher internal order.

The Economic Implication:

This allows pharmaceutical majors to pursue a "Bio-Better" strategy. By re-crystallizing a drug in space, companies can:

Extend IP Lifecycles: Create a new, patentable crystal form of an expiring drug, protecting revenue streams.

Route of Administration Shift: High-purity crystals allow drugs currently requiring hours-long IV infusions (hospital-based) to be reformulated as high-concentration subcutaneous injections (home-based). This drastically reduces healthcare system costs and increases patient adherence.

Case Study Dynamics:

Consider the proprietary work on monoclonal antibodies (like Keytruda). The ability to manufacture crystalline suspensions in orbit allows for a product that is shelf-stable and easily deliverable. The value of these therapeutics often exceeds **

50,000pergram∗∗,makingthelaunchcost(currently<50,000pergram∗∗,makingthelaunchcost(currently<

2,000/kg via heavy lift) a negligible line item in the Cost of Goods Sold (COGS).

Vertical 2: Regenerative Medicine & Organoids

Accelerating the Clinical Pipeline

The second value driver is the cultivation of biological mass.

The Problem: In terrestrial labs, gravity forces cells to flatten against the bottom of a petri dish. This 2D growth does not reflect human biology. To get 3D growth, Earth labs require expensive, complex scaffolding matrices that often introduce artificial variables.

The Orbital Solution: In microgravity, cells float freely and self-organize into 3D structures (organoids) that mimic actual human tissue architecture—vascularization, polarization, and cell-to-cell signaling.

The Economic Implication:

The primary value here is Risk Mitigation in Clinical Trials.

Toxicity Screening: Pharmaceutical companies spend billions on drugs that fail in Phase I/II trials because animal models did not predict human toxicity.

The "Fail Fast" Model: Testing drug candidates on space-grown human heart or liver organoids provides a higher-fidelity data signal than terrestrial models.

Capital Efficiency: By identifying toxic compounds before entering human trials, bio-pharma companies can save hundreds of millions in wasted R&D spend. The "Orbital Lab" becomes a high-leverage due diligence tool for the drug pipeline.

The Infrastructure Layer: The Rise of Free-Flyers

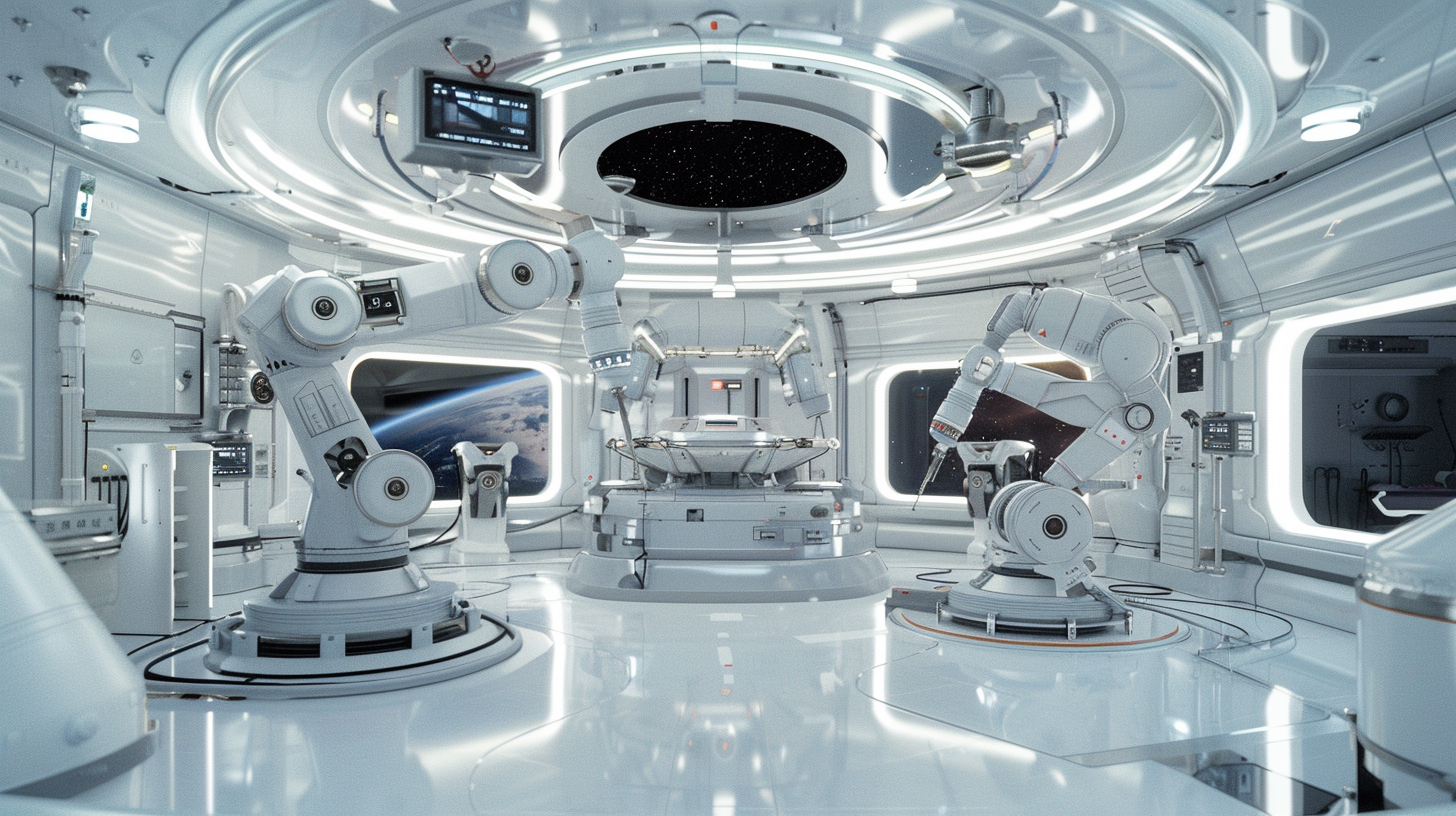

The market has moved beyond reliance on the International Space Station (ISS). We are witnessing the deployment of automated, free-flying manufacturing platforms (exemplified by the architecture of companies like Varda Space Industries).

These platforms represent the "factory floor" of the new space age. They operate on a distinct cycle:

Launch: Raw materials (media, cells) are launched on shared rideshare missions.

Process: Automated labs conduct the crystallization or growth over weeks/months in quiet orbit.

Reentry: The manufacturing module separates and returns the finished product to Earth via a reentry capsule.

Investment Outlook:

This decoupling from human-rated stations (like the ISS) is critical. It removes the vibration of astronaut movement and the high cost of human life support from the manufacturing equation, significantly improving margins.

Risks and Barriers to Entry

While the unit economics are compelling, the sector carries specific structural risks:

Down-Mass Constraints: Getting things up is cheap; getting things down intact is the bottleneck. Reentry requires precise engineering to ensure thermal protection and soft landings do not degrade the biological product.

Batch Scalability: We are currently in the "kilo-scale" era. Scaling to metric tons requires orbital depots and larger reentry vehicles which are currently in TRL 6-7 (Technology Readiness Level).

Conclusion: A New Manufacturing Asset Class

In-Orbit Biomanufacturing is not a speculative science experiment; it is a supply chain optimization play.

For the sophisticated investor, the play is dual-pronged:

Direct exposure to the infrastructure providers building the "factories" (capsules and automated labs).

Indirect exposure via pharmaceutical equities that are actively securing orbital manufacturing contracts to defend their IP cliffs.

We are witnessing the decoupling of manufacturing from gravity. The winners of the next decade will be the entities that successfully integrate the "Orbital Loop" into their terrestrial supply chains.

Sources

Cedars-Sinai - Space Doctors and Stem Cell Production in Microgravity

European Federation of Biotechnology - Biotechnology in Space Exploration

Food Logistics - Impact of Satellite Data to Global Food Security

GEOAwesomeness - How Satellite Data is Transforming Agriculture

Berkeley Space Center - Unlocking the Potential of Space Biotechnology

IoT For All - Harnessing Satellite Data to Promote Sustainable Agriculture

New Space Economy - Biotechnology: A New Frontier in Space Exploration

National Defense Magazine - Experts Extol Potential Benefits of In-Space Manufacturing

Pharma's Almanac - The Final Frontier: Biomanufacturing in Space