Regulations in Space: Governance Frameworks, Resource Utilization, Debris Management, and Economic Growth—A Historical Analysis

Executive Summary

In October 2020, eight founding nations launched the Artemis Accords establishing operational principles for lunar exploration; by January 2026, 60 signatories spanning all continents except Antarctica had joined this plurilateral framework. This validates the pragmatic evolution of space governance from Cold War-era binding treaties to contemporary coordination mechanisms addressing commercial resource extraction, debris remediation, and sustainable orbital operations.

This white paper examines six decades of regulatory development from the 1967 Outer Space Treaty through contemporary national legislation and multilateral initiatives, analyzing framework maturation across governance domains, resource utilization regimes, and debris management protocols. As mega-constellations proliferate and commercial platforms prepare for lunar operations during the 2025-2030 transition window, understanding this layered regulatory architecture becomes essential for evaluating jurisdictional risks, licensing opportunities, and compliance requirements governing the projected USD 170 billion cislunar economy by 2040.

Research Context: Maturation Contrasts and Jurisdictional Fragmentation

The regulatory landscape governing space activities exists as a layered framework with stark maturation contrasts. The 1967 Outer Space Treaty achieved 118 state parties with near-universal ratification establishing principles of peaceful use, free exploration, and non-appropriation. In contrast, the 1979 Moon Agreement attracted only 17 parties—predominantly developing nations—creating a governance vacuum for lunar resource extraction that persists in contemporary debates.

Between 2015 and 2025, jurisdictional fragmentation accelerated. The United States, Luxembourg, UAE, Japan, and Italy enacted unilateral legislation authorizing private ownership of extracted space resources. Simultaneously, mega-constellations from SpaceX and OneWeb strained licensing frameworks originally designed for state-centric activities, with the U.S. FAA averaging 151 days per license authorization pre-reform.

This white paper synthesizes developments across international treaties, national policies from 13 European Space Agency member states plus major spacefaring powers, the Artemis Accords' expansion from 8 to 60 signatories, UNOOSA Working Group benefit-sharing principle drafts circulating since April 2025, and debris management initiatives including the FCC's reduction of post-mission deorbit requirements from 25 years to 5 years and ESA's Zero Debris Charter targeting neutrality by 2030.

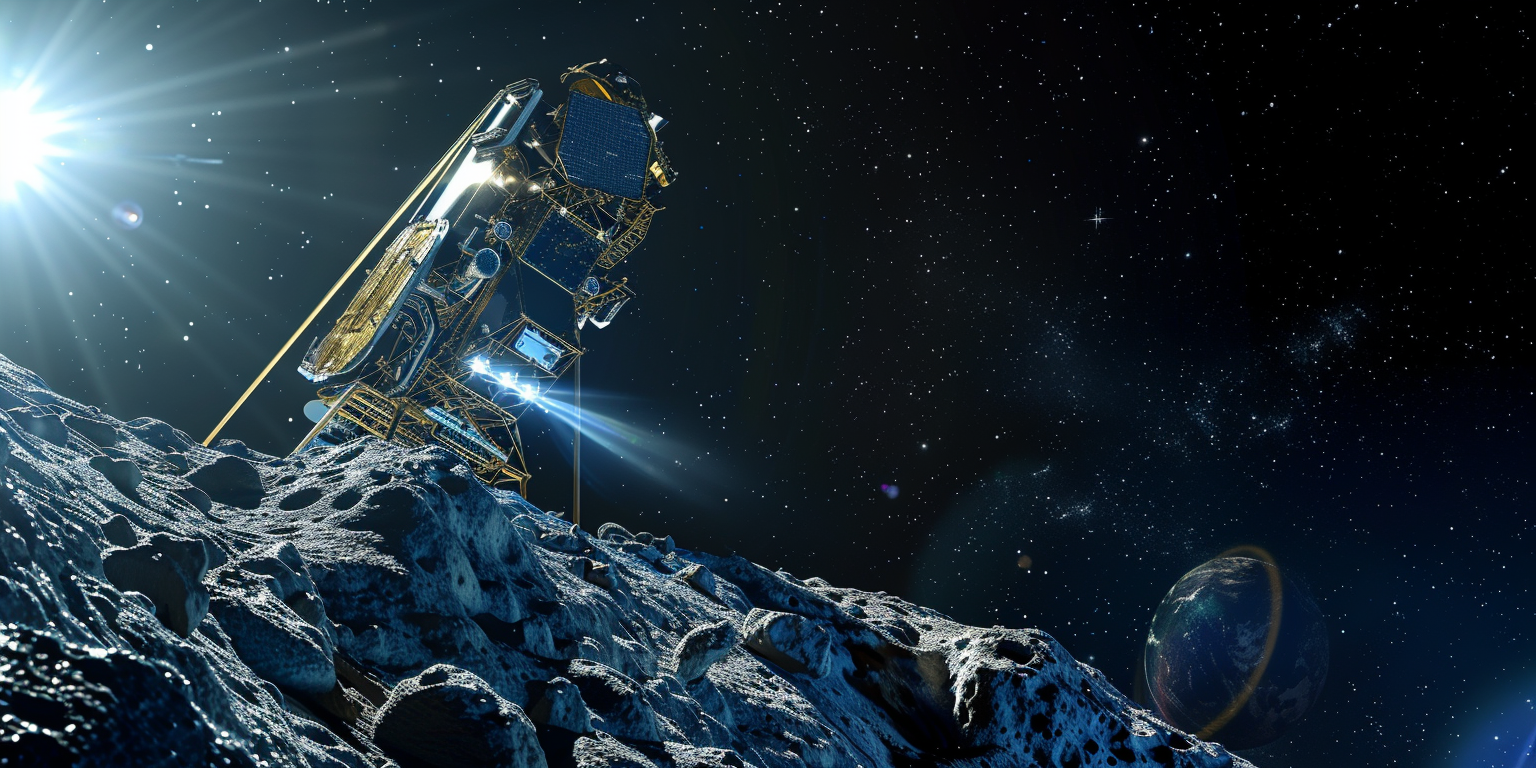

Market projections indicating space debris removal growth from USD 0.1 billion in 2023 to USD 0.6 billion by 2028 at 41.7% CAGR, alongside space mining expansion from USD 50 million in 2025 to USD 185 million by 2030 at 32% CAGR, demonstrate economic momentum intensifying regulatory harmonization pressures during the critical 2025-2030 period as commercial operations transition from theoretical to operational phases.

Validated Findings Across Seven Regulatory Domains

International Treaty Evolution and Enforcement Limitations

Research documented the progression from the 1967 Outer Space Treaty through four successor conventions: the Rescue Agreement, Liability Convention achieving only one formal claim filed in 45 years following the 1978 Cosmos 954 incident where the Soviet Union paid approximately USD 3 million of Canada's CAD 6 million claim for radioactive debris cleanup, Registration Convention with 78 state parties yet only 72% cataloged object compliance, and the Moon Agreement's failure securing 17 parties versus major spacefaring nations' rejection.

This trajectory reveals how foundational consensus on peaceful use and state responsibility contrasts with contemporary fragmentation in resource governance and enforcement mechanisms. The single Liability Convention claim invocation across nearly five decades indicates both the framework's theoretical utility and practical limitations for addressing the exponentially growing orbital debris population, with implications for understanding jurisdictional gaps in novel commercial activities including in-space servicing, assembly, and manufacturing.

National Space Policy Proliferation and Compliance Complexity

From 2020-2025, comprehensive legislative frameworks proliferated across advanced spacefaring nations. Italy's Law No. 89/2025 established unified authorization requiring environmental impact assessments and EUR 100 million minimum insurance with sanctions including 3-6 year imprisonment or EUR 150,000-500,000 fines for violations. Luxembourg's 2017/2020 framework enabled the first European mission authorization to ispace-EUROPE in January 2025. The U.S. ORBITS Act authorized USD 150 million over five years for NASA-administered debris remediation demonstrations.

These developments indicate momentum toward comprehensive regulatory frameworks balancing commercial enablement with sustainability mandates. Yet fragmentation persists through divergent licensing criteria—Luxembourg's ministerial approval for resource missions versus U.S. FAA launch/reentry licensing coordinated across DOT, State, and Defense—insurance caps ranging from Australia's USD 100 million to Italy's EUR 100 million minimum, and authorization timelines creating competitive disparities for multinational operators navigating overlapping jurisdictions.

Space Resource Utilization Framework Divergence

Unilateral legislation from five nations established property rights over extracted materials while affirming OST compliance by distinguishing resources from territorial sovereignty. The U.S. 2015 CSLCA granted citizens rights to ""possess, own, transport, use, and sell"" extracted resources. Luxembourg's 2017 law recognized private appropriation of space resources. UAE's 2019/2023 regulations specified ownership rights over recovered materials. Japan's 2021 Act allowed nationals to own extracted water and minerals. Italy's 2025 law covered resource utilization as regulated space activities.

This contrasts with UNOOSA Working Group protracted consensus-building on benefit-sharing principles, with updated drafts circulating October 2025 and final review scheduled 2026. The G-77 and China consistently emphasize universal access regardless of development level, unconditional technology transfer, and opposition to exclusive exploitation. These fundamental disagreements over commercial incentives versus equitable access parallel UNCLOS deep seabed mining debates, suggesting potential for prolonged multilateral negotiation despite technical ISRU capabilities maturing to achieve 80%+ water recovery rates in drilling-based thermal extraction demonstrations.

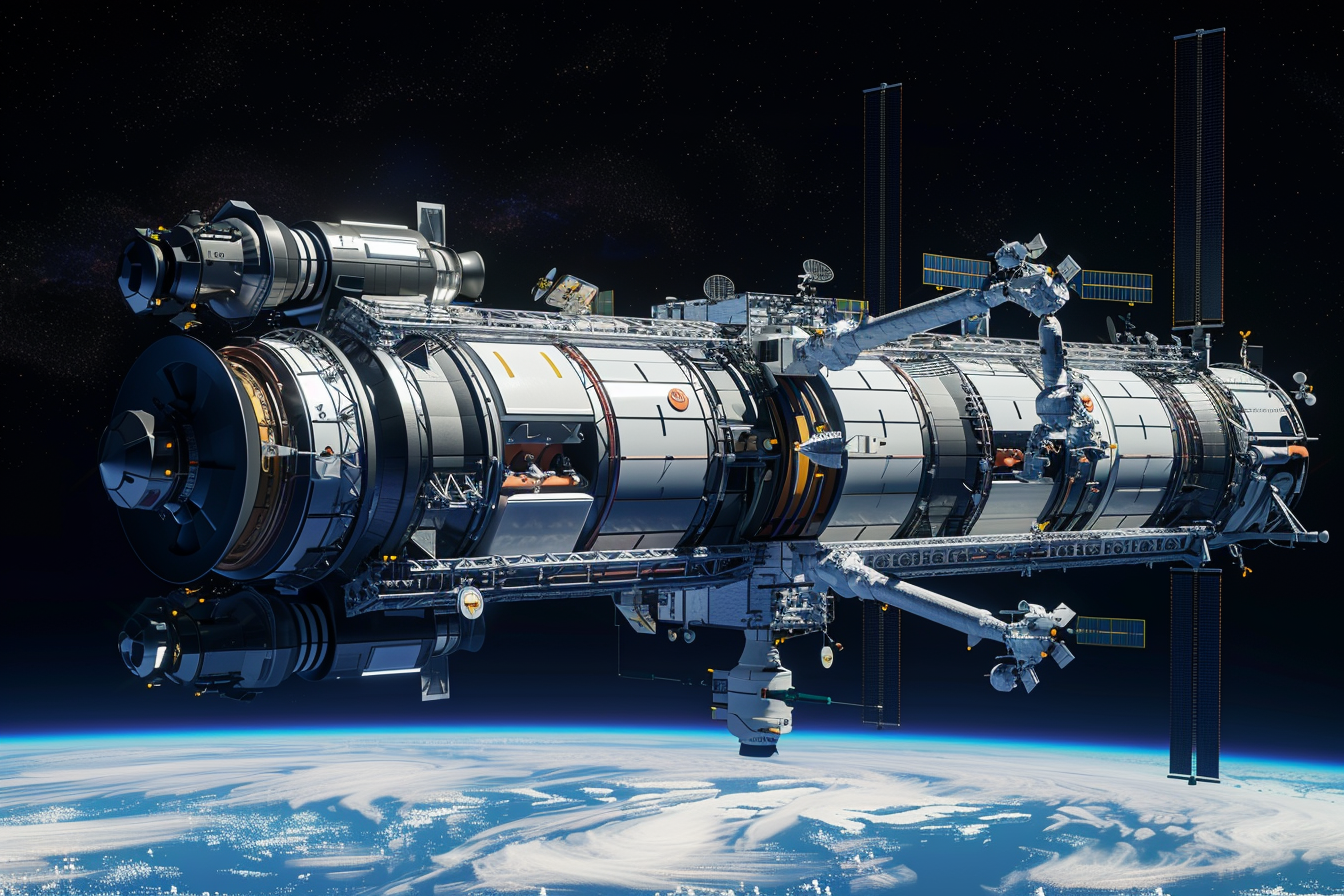

Debris Management Acceleration and Technology Readiness

The 40-year evolution from Kessler's 1978 theoretical concern through operational crisis validation demonstrates regulatory urgency. China's 2007 ASAT test generated 3,000+ trackable fragments with 79% having orbital lifetimes exceeding 100 years; by 2019, approximately 3,000 of the 10,000 tracked threats to ISS originated from this single event. The 2009 Iridium-Cosmos collision produced over 700 trackable fragments.

Regulatory tightening followed: the FCC's September 2022 reduction of deorbit requirements to 5 years for LEO satellites below 2,000 kilometers, ESA's Zero Debris Charter securing 12 European signatories by May 2024 targeting 2030 neutrality with collision/break-up probability maintained below 1 in 1,000 per object. Commercial demonstrations validated technical readiness: Astroscale's ELSA-d achieved magnetic capture validation in August 2021, JAXA contracted CRD2 Phase II for approximately 13.2 billion yen in 2023 advancing to full capture and deorbit with robotic arm technology.

Tracking infrastructure expanded substantially, with LeoLabs operating 10 radars across six sites by 2025 detecting debris as small as 2 centimeters, monitoring hundreds of thousands of objects beyond U.S. Space Command's approximately 35,000 cataloged pieces. This indicates technology readiness outpacing binding regulatory consensus yet creating investable compliance markets as constellations proliferate.

Artemis Accords Operational Coordination and Geopolitical Bifurcation

The Accords expanded from 8 founding nations in October 2020 to 60 signatories by January 2026, including 29 from Europe, first African nations Rwanda and Nigeria in 2022, and India in 2023. The framework establishes principles for transparency through public scientific data release, interoperability standards for infrastructure, safety zones preventing harmful interference, debris mitigation via post-mission hardware removal, and explicit resource extraction rights reconciled with OST Article II non-appropriation by treating extraction as distinct from territorial claims.

Annual Principals' Meetings at IAC and working group sessions address implementation priorities. The 2024-2025 focus emphasized lunar debris handling and sustainability amid commercial missions, with NASA pledging 2026 workshops on transparency and data sharing. This suggests normative influence despite non-binding status, providing operational clarity for aligned nations pursuing commercial licensing and resource extraction ventures.

Geopolitical bifurcation persists. China and Russia's March 2021 ILRS Memorandum establishes joint cooperation emphasizing scientific research and lunar resource surveys while opposing U.S.-led commercialization, with phased development including base construction from 2025-2034 and manned systems by 2040. This creates strategic choice categories regarding alignment with plurilateral operational frameworks versus bilateral partnerships, with implications for market access and technology transfer restrictions.

Regulatory Fragmentation in Developing Nations

Developing nations face institutional capacity constraints and legislative absences creating barriers to commercial participation. Indonesia was drafting laws for commercial space and spaceports during 2020-2025. Malaysia only gazetted regulations in December 2024 under its 2022 Space Board Act. Thailand planned enactment for 2026-2027. Many Asia-Pacific nations lacked comprehensive frameworks during this period, relying instead on agency mandates or draft proposals.

Absence of specific regulations for emerging activities—earth observation, space insurance, situational awareness, resource extraction—creates uncertainty for private operators and hinders international integration. Limited provisions for sustainability, environmental impact assessments, national registries, or revenue generation from orbital slots are evident even in newer laws from UAE (2020) and Italy (2025), which advanced beyond many developing states.

UNOOSA's National Space Legislation Initiative phases (2019-2025) highlight capacity-building needs through information-sharing and questionnaires on legislation status, but progress remains slow. This suggests harmonization pressures and private-sector standards development needs to bridge universal treaty principles and nascent operational requirements.

Commercial Market Dynamics and Investment Barriers

Debris removal projections reaching USD 0.6 billion by 2028 and space mining USD 185 million by 2030 reflect regulatory tightening creating compliance demand for deorbit systems, collision avoidance services, and tracking data. BIS Research forecasts active debris removal market growth at 27.66% CAGR from 2020-2030, with North America expected to hold 61.43% market share by 2030 due to rising investments. Key players include Airbus, Altius Space, Astroscale, ClearSpace, and D-Orbit.

Yet extraordinary capital requirements persist—frequently reaching billions for essential infrastructure with decade-long horizons before significant returns and prolonged negative cash flow periods. Regulatory uncertainty regarding international recognition of unilateral resource laws and enforcement gaps for extraterritorial disputes complicate long-term planning. Technological risks from operational complexity, experimental extraction methods, harsh conditions, and potential hardware malfunctions cause costly delays. Market challenges include undeveloped in-space resource trade mechanisms and uncertain demand/supply dynamics.

Private sector investment in broader space industry experienced volatility during 2022-2025, dipping in 2022 after underperformance but recovering to approximately USD 12.5 billion in 2023, still below previous peaks, reflecting investor caution as the sector matures. Cislunar economy projections of USD 170 billion by 2040 depend critically on regulatory evolution as extraction activities transition from theoretical to operational phases during the 2025-2030 deployment window.

Methodology and Research Scope

This white paper synthesizes regulatory developments across six decades of space governance evolution, examining international treaties from the 1967 Outer Space Treaty through contemporary multilateral initiatives, national legislation from 13 ESA member states plus major spacefaring powers including the United States, China, Russia, Japan, UAE, Luxembourg, and Italy, the Artemis Accords' expansion trajectory and operational coordination mechanisms, UNOOSA Working Group documentation on space resource benefit-sharing principles, and debris management frameworks spanning IADC guidelines, UN COPUOS resolutions, and commercial demonstration missions.

Research evaluated peer-reviewed space law analyses, UN treaty databases and COPUOS session documentation, national legislative texts and regulatory agency materials, government policy statements and executive orders, commercial space industry disclosures including mission authorizations and capital deployment data, and market projections from aerospace intelligence platforms.

A maturation continuum framework maps regulatory domains across universal consensus (core OST principles with 118 state parties), nascent coordination (Artemis Accords plurilateral expansion, voluntary debris mitigation guidelines), and fragmented innovation (unilateral resource utilization laws, divergent national authorization regimes) to identify compliance opportunities and jurisdictional risks. This historical baseline establishes the policy context for evaluating strategic positioning during the 2025-2030 transition period when commercial platforms deploy and national frameworks mature through implementation experience.

Strategic Decision Support Framework

Understanding the layered regulatory architecture spanning universal treaty consensus, plurilateral operational accords, and fragmented national legislation could inform evaluation of jurisdictional opportunities during the 2025-2030 transition period as commercial platforms deploy and national frameworks mature through implementation experience.

The analysis supports assessment of licensing pathways in jurisdictions with established legal certainty—United States, Luxembourg, UAE, Japan, Italy—where property rights regimes, authorization processes, and liability frameworks enable resource extraction ventures, debris removal services, and sustainable orbital operations. Regulatory modernization initiatives including U.S. Executive Order 14335 streamlining launch licensing and FCC Part 100 rulemaking proposing modular satellite applications may reduce barriers for novel activities, with implementation timelines extending through 2026-2027.

Organizations establishing operational presence in aligned regulatory environments during 2025-2027 may achieve positioning advantages when technical capabilities transition from demonstration to commercial deployment. This trajectory is evidenced by ispace-EUROPE's January 2025 mission authorization under Luxembourg's 2017 framework and Astroscale's progression from ELSA-d magnetic capture validation to JAXA's 13.2 billion yen CRD2 Phase II contract for full debris capture and deorbit.

The convergence of regulatory tightening—5-year deorbit requirements, Zero Debris Charter 2030 targets, mandatory environmental assessments in Italy's 2025 law—with market projections indicating debris removal growth to USD 0.6 billion by 2028 and space mining expansion to USD 185 million by 2030 suggests potential inflection points in compliance service demand and commercial viability. Validated technical achievements including 80%+ water recovery rates in lunar ISRU demonstrations and LeoLabs' detection of debris as small as 2 centimeters across 10-radar global networks indicate operational readiness supporting market expansion.

Simultaneously, protracted multilateral consensus-building on benefit-sharing principles (UNOOSA drafts circulating since April 2025 with 2026 final review) and persistent enforcement gaps for extraterritorial disputes, spectrum coordination under strained ITU processes, and novel activity authorization indicate ongoing jurisdictional risks requiring adaptive strategies as governance frameworks evolve. The bifurcation between U.S.-led commercial enablement regimes (Artemis Accords with 60 signatories, unilateral resource laws) and China-Russia state-led scientific cooperation (ILRS partnership with phased development through 2040) creates strategic choice categories regarding alignment with plurilateral operational frameworks versus bilateral partnerships, with implications for market access, technology transfer restrictions, and diplomatic positioning.

These dynamics suggest that understanding regulatory maturation trajectories, enforcement limitations, and harmonization pressures could inform positioning decisions during the critical 2025-2030 period when cislunar infrastructure supporting the projected USD 170 billion economy by 2040 transitions from planning to operational deployment. The analysis clarifies that regulations focus on safety, environmental protection, and activity coordination rather than construction oversight, enabling flexible technological innovation within robust governance frameworks while navigating jurisdictional complexities across overlapping national, plurilateral, and nascent multilateral regimes.

Research Credentials

Scope: 1967-2026: Six decades of treaty evolution, national legislation from 18+ jurisdictions including all major spacefaring powers and 13 ESA member states, Artemis Accords expansion across 60 signatories, UNOOSA Working Group proceedings, IADC/UN COPUOS debris mitigation frameworks, and commercial demonstration missions spanning active debris removal, space resource utilization, and mega-constellation deployments

Sources:

International treaty texts, UN COPUOS session documentation, and UNOOSA legal databases

National legislative materials including statutory texts, regulatory agency guidance, and executive orders from U.S., EU member states, China, Russia, Japan, UAE, Luxembourg, Italy, Australia, UK

Government policy statements, diplomatic announcements, and Artemis Accords bilateral coordination materials

Commercial space industry disclosures including mission authorizations, demonstration results, capital deployment data, and market projections

Peer-reviewed space law analyses, international relations scholarship, and aerospace industry intelligence platforms