In-Orbit Servicing, Assembly, and Manufacturing: Research Publication Announcement

Executive Summary

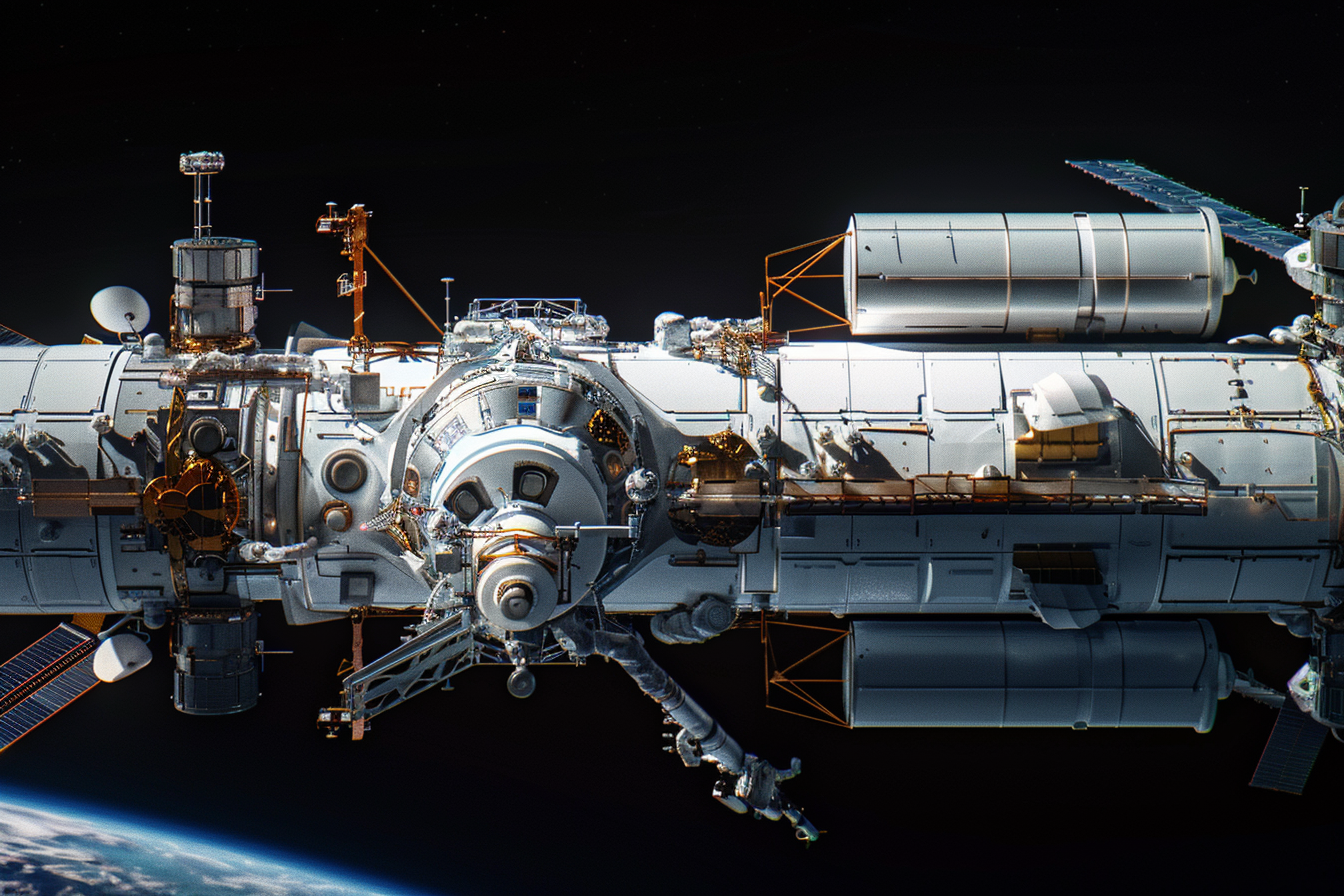

In spring 2024, Northrop Grumman's Mission Robotic Vehicle launched aboard SpaceX Falcon 9, successfully installing a Mission Extension Pod on Optus D3 in geostationary orbit—demonstrating commercial viability for modular propulsion integration with unprepared legacy spacecraft. This validates the economic transition of In-Orbit Servicing, Assembly, and Manufacturing (ISAM) from government-funded demonstrations to operational revenue models. This white paper examines five years of ISAM development (2020–2025) across robotic servicing technologies achieving TRL 7–9, modular assembly systems at TRL 5–7, and microgravity manufacturing at TRL 3–7. As the ISS approaches 2030 retirement and commercial platforms including Axiom Station and Orbital Reef target 2027–2028 deployment, the 2025–2030 transition window creates strategic positioning opportunities in a market projected to reach $17–38 billion by 2030–2035.

Research Context: From Constraint to Capability

Orbital operations face fundamental constraints: satellite replacement costs exceeding $200–400 million, launch vehicle fairing dimensions limiting aperture sizes to ~5 meters, and gravity-driven crystallization defects reducing ZBLAN fiber performance by 10–100× compared to theoretical limits. This white paper examined robotic servicing demonstrations by Northrop Grumman (MEV-1/2, MRV), Astroscale (ELSA-d, ADRAS-J), and Starfish Space; modular assembly programs including NASA's OSAM-1, Lunar Gateway, and commercial station architectures from Axiom and Blue Origin; microgravity manufacturing campaigns on ISS for ZBLAN fibers (Flawless Photonics), pharmaceutical crystals (Varda Space), and bioprinted tissues (Redwire); and orbital logistics infrastructure development by Orbit Fab and government refueling demonstrations scheduled for 2025–2026.

The satellite servicing market reached $3–5 billion in 2024–2025, with projections of $7–12 billion by 2033–2034 at 11–14% CAGR. The in-space manufacturing sector grew from $1.5 billion in 2025 toward projected $28–39 billion by 2034–2035. As ISS operations conclude by 2030 and standardized interfaces (RAFTI, ESA D4R) achieve flight qualification, the 2025–2030 period represents a critical transition from government-led demonstrations to commercially sustained operations.

Validated Outcomes Across Seven Research Domains

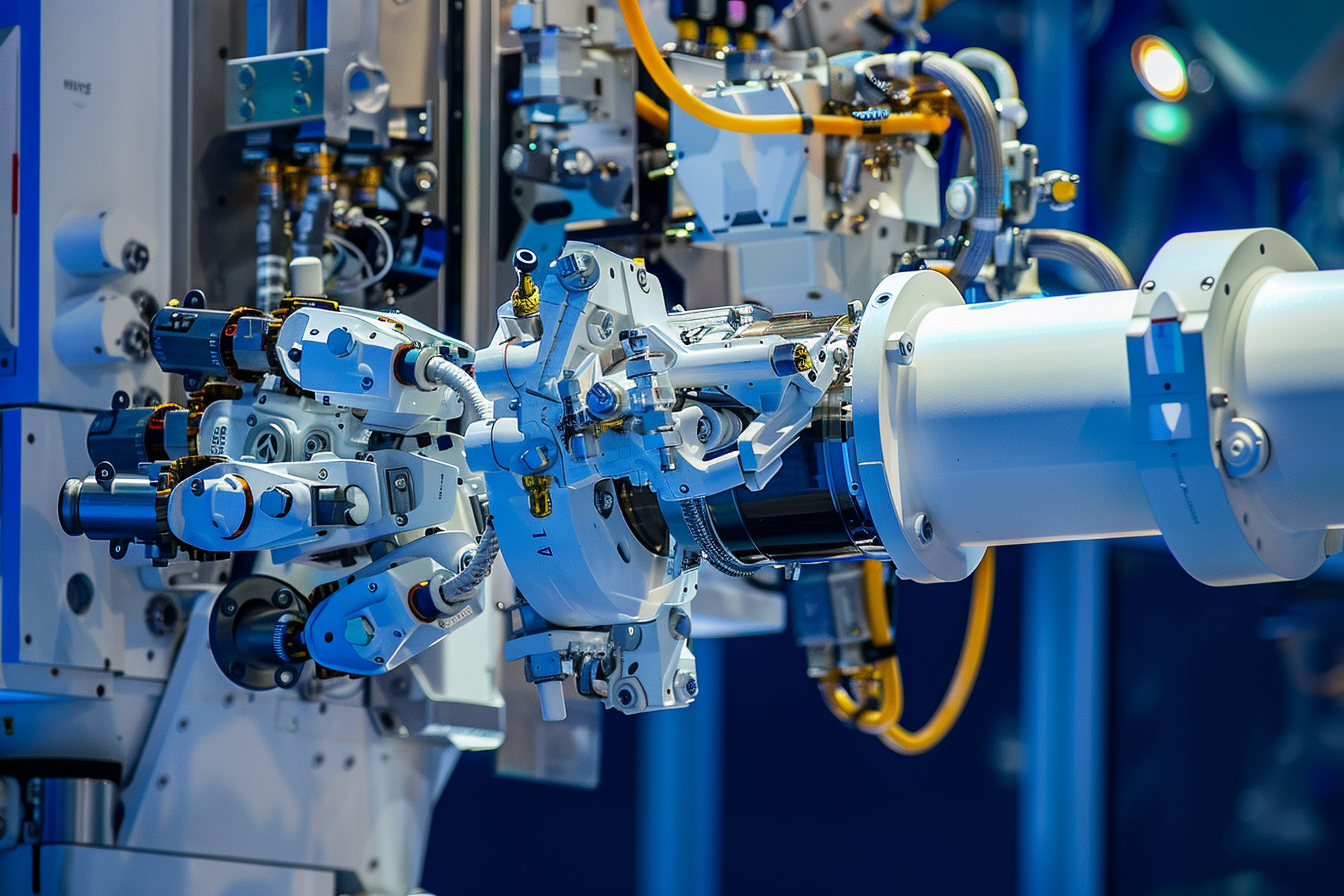

Robotic Servicing Technologies: Northrop Grumman's MEV-1 extended Intelsat 901's operational life from 13 to 24 years through autonomous docking and station-keeping in geostationary orbit, while Astroscale's ADRAS-J completed the first commercial rendezvous with orbital debris at 600 km altitude in 2024, validating TRL 7–9 capabilities for life extension and debris mitigation while revealing persistent gaps in dexterous manipulation under 500-millisecond communication latency and force feedback degradation from radiation exposure.

Modular Assembly Systems: ISS construction required 40+ flights and extensive astronaut EVA, contrasted with Lunar Gateway's 2027 co-manifested HALO/PPE launch on Falcon Heavy and commercial stations (Axiom targeting 2027 AxPPTM docking, Orbital Reef's LIFE habitat burst testing in 2024), indicating maturation from TRL 5–7 for autonomous large-structure assembly with precision metrology requirements ranging from micrometers for optical segments to millimeters for truss positioning.

ZBLAN Optical Fiber Production: Flawless Photonics manufactured 11.9 kilometers on ISS between February–March 2024 at rates exceeding 1 km/day, achieving 10–100× lower attenuation than terrestrial silica through elimination of gravity-driven crystallization, though brittleness and production costs potentially 10× Earth prices constrain commercial scalability to high-value telecommunications and medical sensing applications requiring mid-infrared wavelengths.

Pharmaceutical and Semiconductor Crystallization: Varda Space's autonomous reentry capsules completed three missions through 2025 including ritonavir crystals grown on W-1 and returned in February 2024, plus United Semiconductors partnership for composite semiconductor crystals on ISS demonstrating defect reduction in 86% of 160 materials analyzed (1973–2016), suggesting potential for enhanced bioavailability formulations and power electronics substrates pending resolution of return logistics thermal loads and contamination risks.

Orbital Refueling Infrastructure: Orbit Fab's RAFTI interface achieved Space Force approval in August 2024 and TRL 8 flight qualification, with Tetra-5 and Astroscale LEXI demonstrations scheduled for 2025–2026 in geostationary orbit at $20 million per service, while cryogenic propellant management for deep-space missions remains at TRL 5–6 due to inadequate characterization of long-term microgravity phase-change phenomena and boil-off mitigation requiring zero-boil-off tank technologies.

Standardization Initiatives: CONFERS ISO 24330 and AIAA S-157-2024 voluntary consensus standards endorsed by U.S., Canada, France, Germany, Russia, China, and Brazil, plus ESA's Design for Removal mandates on Copernicus satellites launching from 2026, indicate momentum toward interoperability while fragmentation across docking, power, data, and thermal interfaces persists, increasing mission-specific customization costs and constraining transition to reusable multi-client servicing platforms.

Integration Challenges: Orbital debris requires ESA to perform at least one collision avoidance maneuver per satellite annually with 2023 requirements mandating five-year post-mission disposal, communication latency of 0.1–1 second in LEO and 2.6 seconds Earth-Moon necessitates autonomous decision-making not yet validated for fine motor control, and thermal management in vacuum eliminates convective cooling, requiring multi-layer insulation, heat pipes, and variable emissivity coatings for processes generating concentrated heat during additive manufacturing and crystal growth.

Research Methodology and Analytical Framework

This white paper synthesizes operational mission data, technical demonstrations, and technology readiness assessments from 2020–2025 across government and commercial ISAM programs. Research evaluated robotic servicing missions including Northrop Grumman MEV-1/2 life-extension operations, Astroscale ELSA-d magnetic capture demonstrations and ADRAS-J debris inspection, and Starfish Otter Pup 2 electrostatic docking; modular assembly architectures from ISS heritage systems, NASA OSAM-1 development prior to 2024 cancellation, Lunar Gateway HALO/PPE integration, and commercial station programs by Axiom Space and Blue Origin; ISS microgravity manufacturing campaigns for ZBLAN fibers, pharmaceutical crystallization, semiconductor crystal growth, polymer and metal additive manufacturing, and bioprinted tissues; and orbital logistics infrastructure including Orbit Fab depot operations, NASA propellant transfer system testing, and cryogenic management research.

Sources encompassed peer-reviewed publications in Nature Microgravity and ACS Biomaterials, NASA technical reports and mission documentation, corporate disclosures from servicing providers and manufacturing startups, international standards from CONFERS/ISO/AIAA and ESA debris mitigation frameworks, and market analyses projecting 2030–2035 sector growth. A technology readiness framework maps ISAM capabilities across TRL 3–9 spanning laboratory validation through operational deployment, identifying maturity gaps in dexterous manipulation, cryogenic propellant storage, and autonomous assembly that define private-sector innovation pathways.

Strategic Decision Support During Infrastructure Transition

The analysis supports evaluation of commercial platform partnerships and technology investments during the 2025–2030 ISS transition period as servicing capabilities mature from TRL 7–9 demonstrations to scalable multi-client operations. Understanding infrastructure readiness trajectories—RAFTI standardization achieving Space Force approval in 2024, ESA Design for Removal mandates embedding servicing interfaces on satellites launching from 2026, commercial stations targeting 2027–2028 operational timelines—could inform positioning decisions as orbital logistics capacity shifts from government research facilities to commercial platforms.

Organizations establishing early partnerships in life-extension services, debris mitigation contracts, or manufacturing-as-a-service models may achieve advantageous market entry when the satellite servicing sector scales from $3–5 billion in 2024–2025 toward projected $7–12 billion by 2033–2034. The convergence of validated technical feasibility—MEV missions extending satellite lifespans by 5–10 years, Flawless Photonics producing 11+ kilometers of superior ZBLAN fiber, Varda completing autonomous pharmaceutical manufacturing and reentry—with declining launch costs via reusable rockets and $329 million private capital deployment in orbital manufacturing suggests potential inflection points in commercial viability.

However, persistent technology gaps at TRL 5–7 in dexterous manipulation under communication latency, cryogenic propellant storage for deep-space applications, autonomous fine motor control for non-cooperative satellite capture, and cost-effective return logistics for fragile samples indicate that scalability depends upon sustained private-sector innovation addressing thermal management in vacuum manufacturing, sub-100 millisecond latency compensation for teleoperation, and universal servicing interfaces enabling plug-and-play reconfiguration.

The 2026–2030 window represents a critical period where demonstration success on Tetra-5 refueling, Axiom Station assembly, and commercial debris removal missions could validate business models and catalyze institutional investment, while integration failures or regulatory obstacles could extend timelines for achieving operational sustainability supporting mega-constellations, commercial habitats, and cislunar exploration architectures.

Research Scope and Sources

Scope: 2020–2025: 500+ ISS manufacturing experiments, 15+ robotic servicing missions (MEV-1/2, ELSA-d, ADRAS-J, MRV, Otter Pup 2), 3 Varda autonomous capsule flights, Lunar Gateway development, and commercial station programs by Axiom Space, Blue Origin, and Vast, examining Northrop Grumman SpaceLogistics, Astroscale, Orbit Fab, Redwire Space, Flawless Photonics, Varda Space Industries, and government initiatives by NASA, ESA, Space Force, and DARPA

Sources:

Peer-reviewed publications in Nature Microgravity, ACS Biomaterials, AIAA conference proceedings, and ISS National Lab technical reports

NASA mission documentation, technical reports, and technology portfolio assessments for OSAM-1, Gateway, and in-space manufacturing initiatives

Corporate disclosures, mission announcements, and earnings materials from servicing providers, manufacturing startups, and platform developers

International standards from CONFERS (ISO 24330, AIAA S-157-2024), ESA Design for Removal frameworks, and Space Force acquisition documentation

Market analyses from Grand View Research, Future Market Insights, Mordor Intelligence, and Analysys Mason projecting 2030–2035 sector growth trajectories